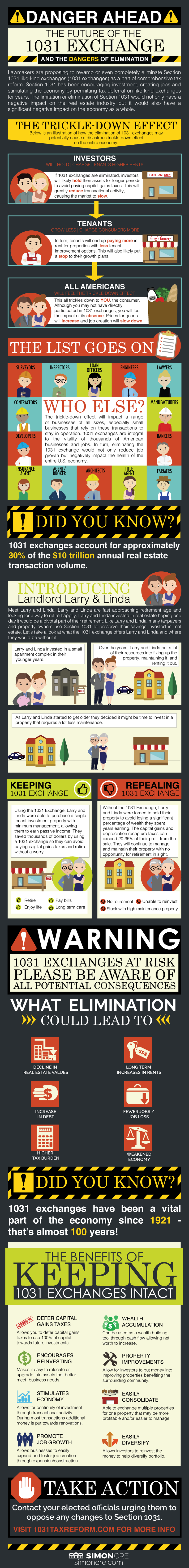

Section 1031 Exchanges have been instrumental in driving real estate and economic activity since their inception in 1921. Just a few years ago, it was in danger of being eliminated, but the commercial real estate industry made a significant case for its positive impact on the industry - and economy as a whole. Thus, the "Tax Cuts and Jobs Act" was signed in 2017 to preserve it, and the proposal itself was eliminated instead.

However, now it’s at risk again of either being repealed or limited. As previously stated, this has the potential to create havoc on the United States economy and disrupt the entire commercial real estate industry. That's why it's crucial to understand the importance of Section 1031 and make the right efforts to preserve it.

Below, we take a look at some more information on Section 1031, including its benefits, its future, and what limiting or repealing the 1031 exchange might mean for our economy and for you.