1031 Exchange Trickle-Down Effect

How Elimination/Limitation Could Affect Everyone

Like the trusted companies John Deere, Colgate, and Walt Disney Corporation that have been around for 100+ years, the Section 1031 tax deferral has also withstood the test of time due to the economic stability it provides.

However, now the century-old 1031 exchange is in danger of becoming limited or even eliminated. Many don’t realize the trickle-down effect it has on not just people in the commercial real estate industry, but the U.S. economy as a whole.

Here are some sample stories to illustrate how it could negatively impact individuals across different occupations.

Farmers

The possible impact of repealing the 1031 exchange would largely stagnate business activity for non-financial assets such as farms and real estate. Here's one sample scenario of how a typical farmer could face challenges when it comes to their family business.

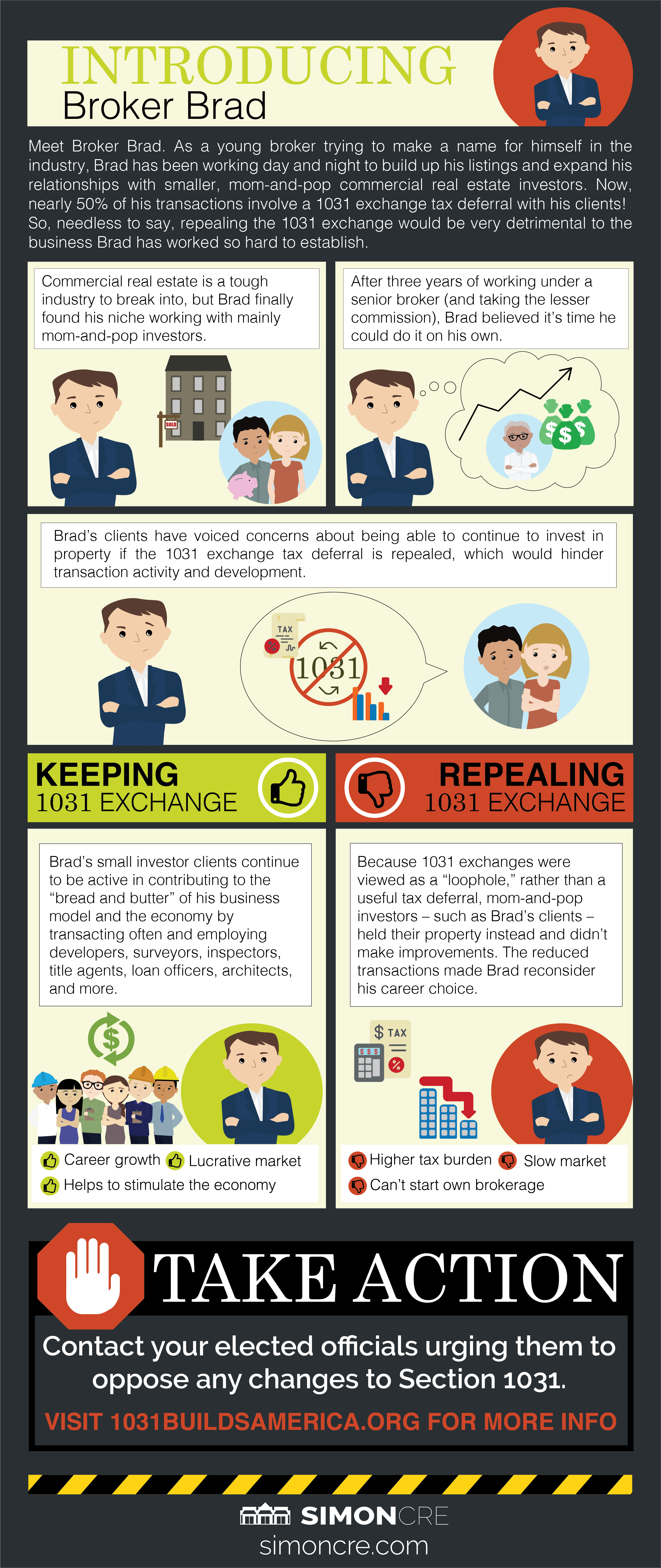

Brokers

If the 1031 exchange is eliminated, the trickle-down effect of investors holding property rather than selling could greatly impact brokers. This tax deferral may be used in as much as 50% of certain investment brokers' transactions. Here is a realistic example of one.

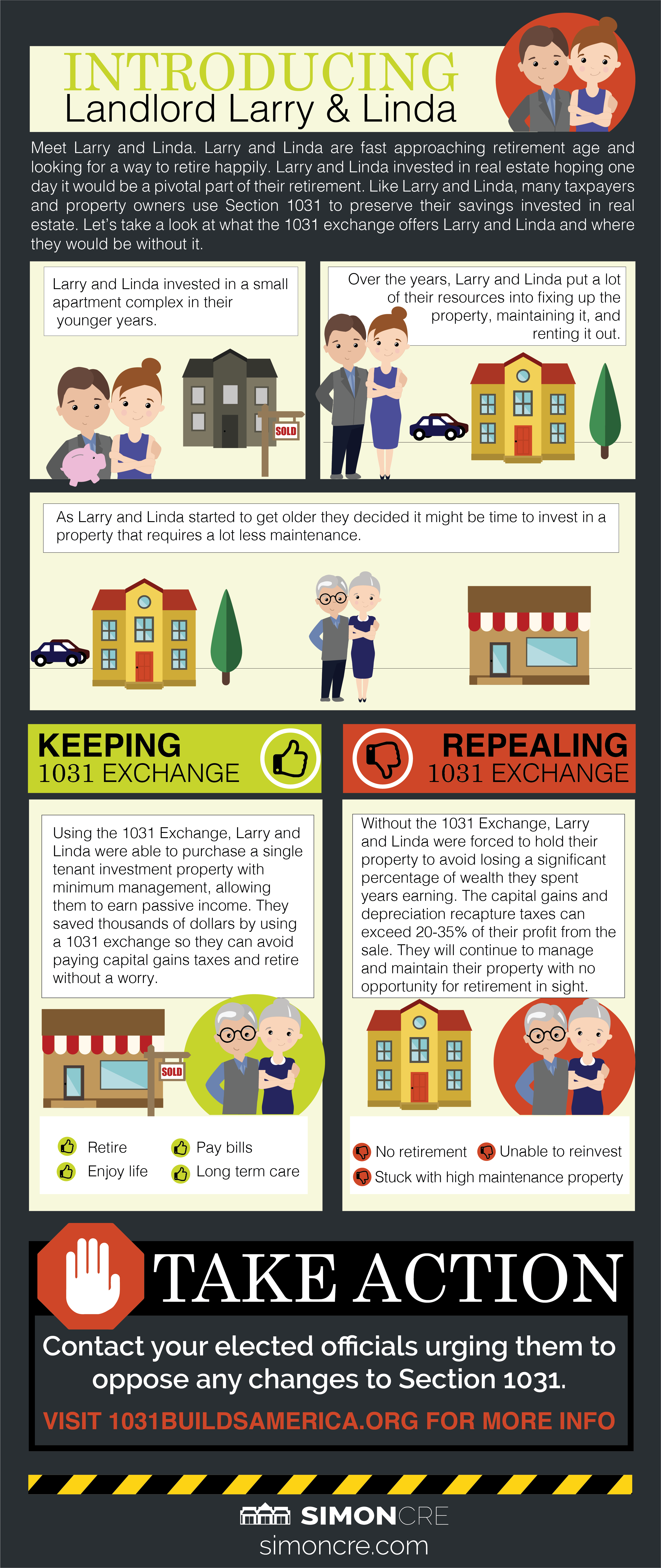

Landlords

Perhaps the first group that comes to mind for policymakers working to decide the fate of the 1031 exchange are the landlords (investors) of commercial property. However, there is not one single profile to fit all those who need the tax deferral. Here is one middle-class couple's struggle with retirement plans as a result of the 1031 exchange repeal.